FUTURE SHOCK OPPORTUNITIES

Avoid the Big Losers, and Ride the Biggest

Tech Boom Winners in over 100 Years

By Martin D. Weiss with Jon D. Markman

In this urgent report, you’ll discover:

- How FUTURE SHOCK 2020 will go down as the single biggest tech-investing opportunity in history …

- How it will crush a handful of traditional “blue chip” stocks, including the 15 “landmine stocks” named in this report …

- How you could have already used this new strategy to see gains of 1,230% … 1,424% … 2,836% and MORE!

If you’d like to skip ahead to our

Future Shock Strategy, click here.

Introduction

We’ve created this urgent report for one reason: To help you avoid the pitfalls — and profit immensely — from one of the greatest disruptions in the history of mankind.

This is no exaggeration, and it’s no joke. We see it happening all around us. And most of us have even experienced it directly, in our own lives.

We call it “Future Shock 2020,” and it’s radically upending our lives more quickly than we’ve ever seen before.

We’ve Been Waiting 50 Years for an Opportunity THIS BIG. Here’s How YOU Can Take Full Advantage of It …

The original concept of “future shock,” as described by author Alvin Toffler 50 years ago, was rapid change that shocks society.

Now, Weiss Ratings, which also began about 50 years ago, has completed a major study that demonstrates Future Shock 2020 is even bigger.

But Future Shock 2020 also represents the single biggest investment opportunity of the next two years.

In this report, we reveal everything you need to know about it right now.

- We name 15 blue chip stocks that could be wrecked by this megatrend.

They’re all big and well known, including some of the largest in the S&P 100 Index. They all merit a Weiss Stock Rating of D+ or lower. And, each one could sink your portfolio with wipe-out losses.

- We show you how Weiss Ratings has issued “buy” signals on the biggest tech winners.

They’ve produced returns of 815%, 902%, 914%, 1,230%, 1,424%, 2,836%, 3,450%, and 6,400%, just to mention a few. (And these gains are strictly with big-cap, highly liquid stocks, using no options or leverage of any kind.)

- We reveal the 1,034% return on one of the largest companies in the world, also thanks to a major Weiss Ratings “buy” signal.

Most investors are very content to double their money on this giant company. See how you could have used it to achieve a 10-bagger — again with no options or leverage.

- We name the NEXT 6 opportunities which could deliver similar gains:

The first is based on a poorly-understood megatrend that’s destined to grow into a $7.1 trillion mega-industry by 2023.

The second, once restricted to experiments that no one understood, is now bursting into our lives with gale force.

The third is driven by a sudden transformation that has swept through 190 countries around the world.

And all six opportunities are rich with immediate and long-term profit potential.

- We walk you through the steps that could help you achieve 159.8% AVERAGE annual returns.

If you’ve ever wanted to grow your retirement funds swiftly without crazy risks, this is the single best chance to do so. And it couldn’t be coming at a better time.

Our goal is to make sense out of what’s happening in the world and give you a roadmap for navigating through it.

We hope you’ll be able to do two things:

First, free yourself — and your money — from the crushing blow the pandemic is delivering to huge swaths of our economy …

Secondly, we hope you can use that freedom to profit from the select few companies that we believe are immune from the economic fall-out. And better yet — that have the best potential to ultimately help save America from this disaster.

Chapter 1

Why the Next 24 Months Could Be Among the Most Profitable of Your Life (Even While Most Stocks Stink)

When the pandemic hit, the economy tanked like never before.

But starting in late March, the stock market enjoyed one of its sharpest rallies of all time.

It begs the question: What gives? Why this disconnect?

The answer: Mostly false hopes, or more accurately, premature hopes — for a quick return to normal, for a quick recovery in the economy.

But it’s not just a disconnect.

It’s also a bifurcation — a split between two entirely different worlds moving though time along two divergent paths — the traditional world of brick and mortar, which is in crisis, and the modern digital world, which is soaring.

Based on everything we know and everything that is known by the U.S. Congressional Budget Office, the World Bank and the IMF, the most intense (and potentially most profitable) time will be the next 24 months.

Here’s the thing: the brick-and-mortar economy is still in shambles, which Weiss Ratings predicted would happen in 2020.

In fact, we issued an alert to our readers that a recession was on its way. We forecast a stock market crash in 2020. We even cited five warnings signs for the year ahead.

And that was before the pandemic.

Indeed, the economic problems we’re having now didn’t begin with the pandemic. After a decade of practically nonstop growth, a recession was already long overdue.

But we repeat: That’s only when we’re talking about the traditional realm of brick and mortar.

There’s also another world — where people work online from home, where students rely on distance learning, where shoppers buy nearly everything they need with a few clicks of their mouse, where millions attend virtual concerts or conventions from the comfort of their living room or from anywhere on the planet.

Welcome to the Brave New World of FUTURE SHOCK … And a Whole New Class of Tech Investments

The pandemic has triggered a veritable Big Bang, injecting great energy into a whole new class of assets.

As we write, these assets are exploding higher — not despite these difficult economic times, but because of them.

The best news: This megatrend is just getting started.

Unfortunately, some people fear these changes. But the fact is, once you understand them, you can relax, embrace them, and turn this situation into a serious profit opportunity.

In fact, Future Shock 2020 represents one the biggest investment opportunities in our half-century in business.

And that’s saying something, considering how closely Weiss Ratings has tracked and rated technology stocks from our earliest days.

Heck, regardless of market ups and downs, technology has always been a driving force of our business. We’ve always been early adopters, not just on the rating of tech stocks, but in the adoption of new technologies.

Weiss Ratings + Technology Stocks = Big Gains

We began rating technology stocks toward the end of 1999, when the Nasdaq was reaching bubble-level peaks.

But while Wall Street firms were unanimously touting them, we issued a landmark report called “Seven Horsemen of the Internet Apocalypse.”

Our ratings showed us what should have been obvious to everyone: Internet stock valuations were off the charts.

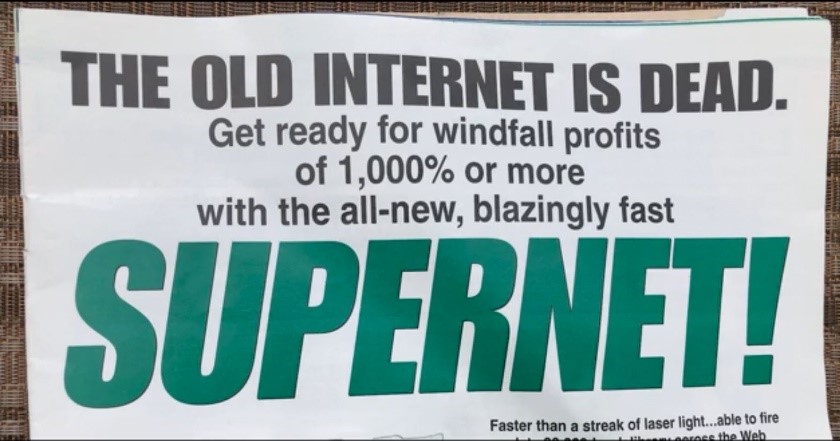

This 2003 Weiss report correctly predicted the greatest tech boom of 21st century:

Weiss and team were right as rain when they warned investors to get the heck out of Internet stocks BEFORE the Dot-Com bust of 2000-2002. Then they were right AGAIN when they issued their first “buy” ratings on tech stocks AFTER the stocks hit rock bottom in 2003. Investors following the Weiss Ratings could have seen dozens of triple- and quadruple-digit returns, ranging from 566% to 15,621%.

Their share prices were up in the stratosphere. But their earnings were down under ground.

In fact, most of them had no earnings whatsoever — just losses.

Even knowing that, we were shocked with the results of our model: Not a single stock on the Nasdaq got a Weiss “buy” rating! Almost every one was a “sell.”

Needless to say, we receive a good deal of blowback from the media and the Wall Street crowd — even some outright mockery.

Then, just two months later, in early 2000, the dot-com bubble burst, and our model proved to be right on target, despite what all the “experts” were saying.

By 2003, investors had lost three-quarters of their money — on average. Many investors lost a lot more.

How We Promised 1,000% Profits,

But the Actual Returns Were Far Greater

This takes us to the next major report we published, with the bold headline: “The old Internet is dead. Get ready for windfall profits of 1,000% or MORE with the all-new, blazingly fast SUPERNET.”

At the time, most investors had abandoned tech stocks.

And most experts said we were promising far too much.

But as it turned out, we greatly understated the true potential; with time, the returns were far larger.

Here’s the key:

Even while the Internet stocks were crashing and investors were running for the hills, the engineers were still hard at work, making major advances in the speed of the Internet.

In our 2003 report, we predicted that telecom engineers will someday fire gigabytes of data through fiber optic cables.

We predicted that “sophisticated computer software and video games will download in seconds.”

We predicted that “Web videophones will give you crisp, full motion video of the people you’re chatting with, instantly.”

Back then, people said it was “science fiction.” Today, it’s the driver behind some of the greatest profits of our era.

How much profits? We’ll answer that question in a moment.

Chapter 2

A Tale of Two Investing Worlds

(And Why You Need to Be in the

RIGHT One)

Today, and for the next two years, the traditional world will remain mired in what we call “the dark side,” dragged down by forces beyond anyone’s control.

But at the same time, the digital world is rapidly leading us to the “light side”, where some very smart people are making enormous strides to get us out of this mess.

And ironically, the pandemic is serving as a kind of “Big Bang” moment for this digital transformation!

So, the time to strike is now.

- In the brick-and-mortar world, we see more financial failures — corporate bankruptcies, personal bankruptcies, even government bankruptcies, but …

In the virtual world, we see a tidal wave of revolutionary innovations.

- In the brick-and-mortar world, we see unprecedented wealth destruction, but …

In the virtual world, we see unprecedented wealth creation.

- So investors have a choice: Either wipe-out losses or …

Life-changing profits.

Some folks might think these two world’s can’t co-exist; can’t happen at the same time. But it already IS happening at the same time.

It’s like two separate asset classes. Like the dollar going down and gold going up. Or like office space in Manhattan going empty while residential property in the country is in huge demand.

As investors run away from the brick-and-mortar world … and rush to the digital world … they drive values DOWN in the former and UP in the latter.

That’s why we issue RATINGS — to help investors distinguish between the two, to recognize that not all stocks are created equal …

And to pounce on the companies with great business models … plenty of cash … PLUS and the ability to extract maximum profits from Future Shock 2020.

So what kinds of opportunities are we talking about, specifically?

Let’s start with the most obvious one — and one you’re likely familiar with.

Zoom Is Just ONE Example of a FUTURE SHOCK

Windfall. Our Other High-Rated Stocks Could

Soar Even Higher

We’re talking about Zoom Communications — the video-conferencing stock that has soared nearly 300% in a few short months.

We ourselves had already moved our entire company to Zoom long before the company went public.

And Weiss Ratings tech specialist, Jon Markman, recommended Zoom to his subscribers on March 16th of this year, just as the lockdowns were beginning.

In fact he did better than that. He recommended Zoom call options. If subscribers bought those call options at the market and converted them into shares, they could have seen gains of 2,000% or more.

And the key to understanding these gains is clear.

Just look around you, in your immediate environment, and think about it.

Are you using new apps or video conferencing to communicate with loved ones or colleagues since the coronavirus hit?

Have you changed your daily habits accordingly?

If so, then you’ve already experienced Future Shock 2020 first hand.

And that’s why this megatrend is so powerful, why it’s impacting the entire planet all at once.

And that’s one of the things creating the single biggest tech-investment opportunity since the dawn of the Industrial Revolution!

Remember: Our Weiss Ratings are not just good for warning folks away from stocks that are vulnerable to a crisis, they’re also good at picking stocks that are most likely to go up — in good times and bad.

If our track record is any indicator, these gains could prove truly historic — and life-changing for anyone who gets in now.

Should you buy Zoom shares today? No. That ship has already sailed.

But don’t fret. Larger and broader opportunities are still to come. And we’ll get to those in just a moment.

Chapter 3

How the Weiss Ratings Have Guided Investors to Some of the World’s Biggest Tech Stock Gains of the 21st Century

Earlier, we told you about our 2003 report predicting a blazingly fast “Supernet.”

That’s also around the time when Weiss Ratings issued its first “buy” ratings on a short list of tech stocks that have since helped create the digital world of today.

On January 2, 2004, we issued a “buy” rating on Citrix Systems. Since then, it has delivered a total return of 815% to investors.

We issued a “buy” on Cognizant Technology Solutions, which has delivered a 902% return.

CGI — 914% return.

Jack Henry & Associates — 1,000% return.

Fair Isaac Corporation — 1,230% return.

Amphenol Corporation — 1,245% return.

Ansys, Inc — 2,836% return.

Tyler Technologies — 3,450% return.

Then we issued a “buy” rating on Global Payments, which delivered a return of 1,332%.

On Microchip Technology — 566% return.

IEH — 6,400% return.

Intuit — 1,424% return.

Manhattan Associates — 1,285% return.

Lam Research — 1,580% return.

What’s more, our Weiss Ratings have maintained a “buy” or “hold” on all of these stocks since the original “buy” ratings issued in 2004. That means we have not once issued a “sell” on any of these companies.

It also means investors who have followed our ratings should be reaping every penny of the gains until this very day, minus broker commissions and taxes, of course.

The True Story Behind Our Biggest

Weiss Ratings Winner Ever: a 15,621%

Moonshot that’s STILL Climbing!

Weiss Ratings issued its first “buy” rating on Microsoft on September 30, 2004. Total return to date: 1,034%.

That’s a nice 10-bagger, of course.

But interestingly, there’s another stock which got a Weiss Ratings of “buy” only three days earlier, and its return has been many times better.

No, it wasn’t some high-risk, small-cap stock.

It was Apple.

We issued a “buy” rating on Apple on September 27, 2004, and since then, we have not once downgraded Apple to a “sell.”

So if you had simply followed our ratings, you would have reaped a total return of 15,621%. That’s fifteen times better than Microsoft!

Even better, our Weiss Ratings were giving us insights and signals few others saw at the time.

In September of 2004, Apple shares had recently taken a big beating and was mostly shunned. There was no iPhone. In fact, the iPhone was still nearly three years away.

The Weiss Rating of “buy” on Apple was issued almost three years before the iPhone was launched.

It should be fairly obvious that our team didn’t discover technology yesterday.

We’ve been working on this for a long time. (And we also warned investors away from tech stocks before they crashed back in the early 2000s.)

Your Simple New Tool for Timing Tech-

Stock Breakouts … And Breakdowns

There are many Wall Street firms who recommended buying Apple or Microsoft at some point.

But they almost never tell investors to sell before a big crash.

How do we do it?

Well, we’re not any smarter than they are. Nor do we have better access to data.

The main difference is …

We don’t have any business relationship whatsoever with the companies we rate. We never take a dime from them for our ratings. No hard dollars. No soft dollars.

So, if a company gets a “buy” rating from Weiss Ratings, it’s a true “buy” rating — not a rating that’s bought and paid for by the rated company.

Likewise, we are not shy about flagging any company that falls below our Weiss Ratings standards.

That’s why The Wall Street Journal reported that investors following our Weiss Stock Ratings could have made more money than investors following Merrill Lynch, Goldman Sachs any of the Wall Street firms they reviewed.

The second reason we outperform stems naturally from the first: We do have an axe to grind FOR the investor; we are very concerned for investor safety.

So we don’t look strictly at the typical things that Wall Street analysts look at.

Yes, P/E Ratios, EBITDA and Phase 3 trials are important.

But we also have a set of proprietary formulas that give a pretty heavy weight to what we call “stabilizing factors.”

Not just earnings, but CONSISTENT earnings.

Not just dividends, but a long HISTORY of rising dividends.

Not just good upside price momentum, but also limited downside risk.

So unlike 99% of “technology” investors out there, we’re not looking for a quick-hit return at any cost.

We also value relative SAFETY. And it’s among the safer companies that you’ll find the ones that will be leaders for the long term, that will truly make this great transformation happen.

Chapter 4

The Four Great Tech Revolutions

of All Time. Why This One Is the

Biggest and Swiftest of All

As we showed you in prior chapters, even before the shock waves of the pandemic began to sweep through society, we were already witnessing a massive shift of people and wealth from the brick-and-mortar world to the online world.

And long before that, our Weiss Ratings technology team predicted it was going to be one of the greatest megatrends of the century.

This is especially true for Weiss Ratings’ technology leader, Jon Markman, who has been writing about this megatrend for years.

He calls it the Great Digital Transformation.

It’s a transformation in homes, schools, doctors’ offices and workplaces that’s accelerating right now, thanks to the pandemic and its fallout.

But it was well in place even before Covid-19 hit.

- According to IDC, Digital transformation spending is projected to hit $7.1 trillion by 2023. And they say more than 50% of all IT spending is shifting toward digitization — right now.

- A United Nations study is even more on point. It shows that the digital economy continues to evolve at breakneck speed, driven by the ability to collect, use and analyze massive amounts of data about practically everything.

- IP traffic (data usage on the Internet) has grown from about 100 gigabytes per day in 1992 to more than 45,000 gigabytes per second in 2017. By 2022 it’s projected to reach 150,000 gigabytes per second.

Think about that. From 100 gig per day to 150,000 gig per SECOND! That means Internet usage will have expanded by nearly 13 MILLION percent.

But the transformation is not just about numbers. It’s also about people, society, civilization. It’s a revolution unlike any we’ve witnessed in history.

And it’s being driven by the same thing that has always helped drive progress: Technology!

In fact, this is actually the fourth time we’ve witnessed a technology explosion like this one — over the entire course of human existence.

Tech Revolution #1

Go back three and a half million years.

Primitive man creates the first stone tools — for crushing things, for cutting and later, to fashion weapons.

It’s the stone age revolution, a new technology so powerful that it opens the door to a great expansion from Africa into Asia, Europe and eventually the Americas, with phenomenal growth in human population. That was the first great future shock.

Tech Revolution #2

Next, fast forward to 8,500 b.c. — to the first agricultural revolution. this time, the new technology is seeds, especially grass seeds, such as flax, rice, barley. Man learns how to plant them, harvest them and store them. and with the storage of grains comes the first opportunity to accumulate wealth and build civilizations.

Tech Revolution #3

The third future shock begins 260 years ago, not coincidentally, just a few years before the American Revolutionary War.

A few basic machines — the loom, the cotton gin, the steam engine — are invented. They unleash a chain events that totally changes the face of earth as we know it — first with textiles and culminating with railroads.

It’s the industrial revolution, and it creates more new wealth than all the wealth created in the ten millenniums that came before it.

Tech Revolution #4 Is the Most Profitable in the History of Mankind. And It’s Under Way RIGHT NOW!

That’s right. Now we have the biggest and swiftest of them all, the digital revolution.

The Industrial Revolution created massive wealth infinitely greater than the wealth created by any technological revolution that preceded it. The Digital Revolution is many times larger.

But, as in each prior revolution, it’s not just about new technology.

Also bursting onto the scene are new ways of learning, working, living, thinking, and a new wave of wealth creation for investors like none other before.

It’s a global transfer of information — and wealth— from offline to online.

It was already happening before the pandemic: The world was already transforming nearly everything we do — plus nearly all the financial assets we own — into zeros and ones.

And now, Future Shock 2020 is greatly accelerating that process.

Result: It will send select stocks soaring, as we’re going to show you in a minute.

But beware: It will also be devastating for companies that are left in the dust.

How Future Shock 2020 Is About to Crush these

15 “Blue Chip” Stocks

The sudden explosion of digital technologies means traditional businesses are being replaced — rapidly.

We’ve already seen a long list of corporate bankruptcies this year. And we’re about to see a whole lot more.

So your first step is to take a close look at your current portfolio … and prune any weaklings.

A recent scan of the Weiss Ratings models reveals a growing list of blue chip stocks that are in deep trouble as we speak.

Among big oil companies, they are Exxon Mobil, Schlumberger, Occidental Petroleum, and Halliburton.

Among the nation’s industrial giants, Boeing, Raytheon Technologies, General Electric, Dupont, Ford, Dow Inc., and Altria Group.

In the travel and transportation sector, companies like FedEx and Booking Holdings.

Plus, retail giants like Walgreens and mall operators like Simon Property Group.

All of these companies are in the S&P 100 index. So they’re big. And all of them merit a Weiss Stock Rating of D+ or lower, which means “sell.”

That’s the dark side.

Now turning our attention to the bright side, let’s talk about how we’re going to be impacted by the digital transformation, and more importantly, how we’re going to turn it into a massive opportunity.

Chapter 5

Today’s Six Best Future Shock

Profit Opportunities

Let’s drill down to the six technologies poised to explode the fastest.

The first one should be pretty simple to grasp.

If you’ve transitioned from Blockbuster to Netflix … from bookstores to Kindles … from cash to ApplePay … from on-site brokers into online brokers …

You’ve already transformed a big chunk of everything you do into data!

And that’s just the first step …

FUTURE SHOCK OPPORTUNITY #1

The Artificial Intelligence

Gold Mine

Once we computerize massive amounts of data, we can teach computers how to learn from that data.

Better yet, the computers can teach us things that we probably would not have known any other way.

We’re talking about AI — Artificial Intelligence.

So you might wonder: Of all the companies in the world, which one uses artificial intelligence the most?

The answer is Amazon.

Amazon has the biggest Artificial Intelligence platform in the world. Even its Alexa digital assistant, which some people were skeptical about at first, is becoming a huge AI platform in its own right.

Anyone who shops on Amazon can see how that works. It always gives you recommendations on what to buy.

Now, you might think that’s pretty simple, but it’s not.

Behind what you see on your Amazon shopping cart is a mammoth engine of data crunching, which is very complex.

It not only learns what you like to buy, but also how and when, down to the exact time of day.

It learns and maps out your shopping habits in the finest detail. And thanks, in large measure, to that giant data crunching engine, Amazon now dominates the world of e-commerce.

That does not mean you should rush out and buy Amazon right now. In fact, don’t rush out and buy any stock we discuss in this report.

For that, you need to wait for our buy signal and confirmation — and in many cases, we won’t see those until we see a pullback in the shares.

But if you’re concerned about missing out, no worries! Those pullbacks happen all the time.

Meanwhile, the biggest obstacle investors have to making money in AI is this: Very few people know exactly what A.I. does or how it works.

Folks think artificial intelligence is something that happens in far-away computer labs that no one understands. But …

As you’ve seen with the Amazon example, that’s simply not true. A.I. is already a huge part of our lives, humming away in the background.

Just last year alone, businesses spent $1.3 trillion on digital transformation strategies. It’s happening a lot closer to home — in schools, offices, stores, factories, hospitals, clinics. And it’s coming on fast.

Or consider online shopping, for example. One company we’re looking at has a simple smartphone app that lets you shop online for clothing that fits YOU in more ways than one.

You enter your measurements. You tell it your preferences. And you can even upload a picture of yourself. Then they match your personal data with products from over 17,000 brands.

Suddenly, you find yourself in a virtual store where every single item on the rack fits you and your personal tastes. The entire “store” has “learned” your personal preferences.

The company claims that customers using its app are three times more likely to purchase than other customers.

And that could triple sales across multiple retail sectors!

So, you can imagine the investing potential here.

But it could pale in comparison to our next FUTURE SHOCK opportunity …

FUTURE SHOCK OPPORTUNITY #2

The Coming $200-Billion

Explosion in Educational Technology

Educational Technology (EdTech) is a global industry that just got a massive shot in the arm from the pandemic.

Our own Weiss School for gifted children in Palm Beach Gardens was among the first to go 100% online.

Now tens of thousands of schools are following the same path, and the reason should be obvious …

At its peak, the virus caused nationwide school closures in 190 countries. That impacted 90% of students on the planet, almost 1.6 billion kids in all.

It drove shock waves through the entire world of education. So it should come as no surprise that educational technology, EdTech, is now taking off like rocket.

EdTech includes the virtual classroom, which gives each and every student a front-row seat next to the teacher and her whiteboard.

EdTech can teleport students into a world of augmented reality where they can test mechanical models and design the machines of the future.

And it’s huge. It was a $100-billion industry back in 2015 and it’s expected to grow to $300-billion by 2025.

One of the first companies in this industry was 2U. Jon Markman interviewed the founder soon after it went public and recommended it at about $14 per share before is surged to $98 a share.

Or consider Google Classrooms. It had about 50 million active users in early March. Now it has more than 100 million. And one of the features we like the best is that teachers can manage the entire class on the go with their iPhone or Android device.

Meanwhile, our entire business has moved online, too … which brings us to the next massive opportunity …

FUTURE SHOCK OPPORTUNITY #3

20-Bagger Gains from

“Work-from-Home” Tech

Before the Covid crisis, Zoom had about 10 million daily meeting participants.

Last we checked, they had 300 million!

This insane growth is what helped drive the stock through the roof.

It’s why Jon Markman recommended Zoom call options to his subscribers before it took off.

And it’s why you could have made so much money with them. If you had bought them at the market when he issued his “buy” alert and converted them into shares, you could have seen gains of 2,000% or more.

Plus, our company is benefiting in another way: With tools like Zoom, we now hire skilled staff from anywhere — in small towns all over the United States and in English-speaking countries all over the world.

This lets us tap into an online labor market like never before. And it gives a new opportunity to folks who previously couldn’t even dream of landing a job with a company hundreds or thousands of miles away.

But we’re certainly not the only ones. According to an MIT study, before the Covid crisis, only about 15% of the U.S. workforce was online. Now, it’s about 50%. That’s a massive migration to virtual workplaces.

And here’s something that may surprise a lot of people: Nearly everyone assumed that working at home is less productive. But in most cases, working remotely is more productive.

The thing is, productivity doesn’t happen automatically. People need to learn how to do it. And Jon has found a unique company, ServiceNOW, that’s a leader in helping companies get there.

He also interviewed this company’s founder in its early days, and since then, its shares are up by over 1,600%.

But he’s looking at a company right now with much greater potential. As soon as he confirms, he’ll make the announcement to his readers, no doubt.

Another trend that will certainly impact work-from-home and commuting life is …

FUTURE SHOCK OPPORTUNITY #4

Autonomous Vehicles

(And Not Just Cars!)

One of the first to alert investors was, again, Jon Markman.

Autonomous vehicles were taking off before the pandemic. And now, they’re just skyrocketing.

You see, most people who order merchandise or groceries or meals online would prefer NOT to go to the store for pick-up. And sometimes, there is no store nearby.

So they get nearly everything delivered to their home. And the safest, fastest way to do that is with autonomous vehicles.

That’s sending mountains of capital flooding into a handful of companies that are making it happen — fast.

Why the rush? The vehicles can do a lot more than just delivery. They can disinfect roadways. They can patrol the streets. They can sound alerts if they detect people breaking rules, such as social distancing rules.

Google, through its Waymo division, has been investing heavily in this area.

Not just in driverless cars, but driverless taxis, driverless trucks and driverless delivery vehicles.

Other companies are jumping in, too.

In Michigan, you’ve got Refraction AI.

In California, Kiwibot is making sidewalk robots.

Phantom Auto makes software to control delivery robots.

And all of these have gotten one heck of a boost from the pandemic.

Plus, here’s something not many people know about:

Microsoft has moved heavily into this area with what’s called Telematics, or connected car systems.

They make advanced navigation systems and driver assistance tools, all of which feeds into the science of driverless cars.

FUTURE SHOCK OPPORTUNITY #5

$10,000 into $210,000

with Next-Gen Robotics

For most people, a world filled with robots seems years or decades away.

But it’s not. Especially in East Asia, robots have long been the norm in factories and assembly lines. Plus they will soon be the norm in schools and offices.

Jon has picked out one company in particular, Cadence Design, that helps companies design chips for robotics and automation.

It’s already up over 2,000% since 2009 and it’s making all-time new highs as we speak.

If you had invested $10,000 in the stock, you’d be sitting on $210,000 today … and counting.

But with the pandemic sending demand for robots soaring worldwide, the big gains are just getting started.

FUTURE SHOCK OPPORTUNITY #6

The Coming $267-Billion

Telehealth Boom

Telehealth is the digital transformation that’s sweeping through the $3.3 trillion healthcare system right now.

Just in the first quarter of 2020, funding for new telemedicine companies exploded by nearly 20 times.

Globally, telehealth was valued at $50 billion in 2018. Now, Fortune forecasts it will be a $267-billion market by 2026. That’s a four-fold explosion.

Take Teledoc Health, for example. It provides online medical consultations, which, by the way, are covered by Medicare and private health insurers.

Or consider the consortium owned by Amazon, JPMorgan and Berkshire Hathaway. They want to help companies bypass insurance companies to provide healthcare coverage directly to their employees.

How does that connect to the Great Digital Transformation?

Well, the digital transformation is what makes it possible for them to cut out the middleman — the insurance companies.

And like our other Future Shock opportunities, this boom is just getting started.

In addition, these aren’t the only opportunities we’re seeing — just the best right now.

And the key to profiting from FUTURE SHOCK 2020 … the biggest technology opportunity ever …

Is very simple.

We’ve created a future shock strategy that any Weiss Ratings subscriber could use to make a not-so-small fortune …

Chapter 6

Our Future Shock

Strategy — Revealed

Future Shock 2020 is a worldwide economic disruption unlike any other in modern history.

It’s creating unprecedented investment perils — and unlimited investment opportunities.

It’s the ideal time to reveal a breakthrough strategy so powerful, you could already be outperforming the S&P 500 by NINE to 1.

And that’s even without the benefit of the many triple- and quadruple-digit winners we’ve talked about already.

In our presentations, you’ve seen how investors following our Weiss Ratings “buy” signals could have made total returns of 815% on Citrix Systems … 902% on Cognizant Technology Solutions … 1,230% on Fair Isaac Corporation … 1,245% on Amphenol Corporation … 2,836% on Ansys, Inc. … 3,450% on Tyler Technologies.

You’ve seen how they could have made returns of 1,332% on Global Payments … 6,400% on IEH … 1,424% on Intuit … 1,285% on Manhattan Associates … and 1,580% on Lam Research.

Plus, you probably cannot forget this number: The 15,621% investors could have made with Apple — just by following the Weiss Ratings.

But those are strictly one-up examples. To truly build wealth consistently over time, you need a comprehensive and balanced PORTFOLIO strategy.

Five Very Logical — AND Profitable

Steps Behind Our Future Shock Strategy

Here’s how it works …

Step 1. Behind each letter grade we issue to every stock on the market (grade A, B, C, etc.), we also have unpublished numerical scores on a scale from zero to ten that we use strictly internally.

Plus, we have numerical scores which we call “Weiss performance ratings,” also unpublished.

Step 2. Based on those numerical scores, we rank all the stocks — from the extreme top of the pyramid (#1, #2, #3, #4 …) all the way down to the bottom of the heap (#9,337).

Step 3. We invest strictly in the TOP TIER (typically the top ten).

In other words, we select the ultimate cream of the crop: The top one-tenth of one percent of every stock on the market.

This helps us buy strictly the stocks that have the ideal combination of profit potential AND relative safety — all based on the unpublished scores behind the Weiss Ratings.

Step 4. If a stock’s ranking stays in the top tier, we hold. If it drops out of the top tier, we look to sell and replace it with a stock that has risen into the top tier.

Step 5. We apply our econometric model. As long as it gives us a “thumbs up” signal, we continue the program just as we’ve described it here. When it gives us a “thumbs down” signal, we allocate more money to cash and we look to add downside protection with hedges.

We first introduced this portfolio strategy in 2014. And we demonstrated that, if you had followed the strategy over a ten-year period, you could have earned an average yearly total return of 58.7%.

Now, we’re pleased to announce a major UPGRADE to our Weiss Ratings Portfolio strategy …

Our New (and Prudent) Future Shock Strategy

That Beats the S&P 500 by 8.8 to 1!

The strategy has one key difference:

We apply it strictly to stocks that directly or indirectly benefit from the great digital transformation that’s sweeping the globe — and should continue to do so for generations to come.

How much could you have already made following our Future Shock Strategy?

The answer: Average annual returns of 159.8%!

By comparison, over the same period, the S&P 500 has generated just 18.3% average annual gains.

But if you had followed the Weiss FUTURE SHOCK Strategy you could have outperformed that by 8.8 to 1!

And it’s 100% appropriate for an IRA or other retirement accounts.

That’s because we’ve designed this strategy so that it generates these enormous gains without ever using options, futures, leverage or day trading of ANY KIND.

We use strictly ordinary stocks and ETFs you can buy in a tax-protected or regular brokerage account.

This is a huge benefit. Because it means you could use this strategy is not just for your play money … but also for your CORE funds.

Let’s say you invested $100,000.

How much money could you have made?

- If you bought and held the S&P 500, you’d have $273,000 today (minus broker commissions and any taxes, of course).

- If you bought and held the Nasdaq 100, you could have done better. Your $100,000 would be worth about $714,000 today.

But …

Of course all investing involves risk. If anyone tells you that you can eliminate risk entirely or that an investment strategy is “absolutely safe” or “100% certain,” show him to the door.

So always remember: The goal is to reduce risk — not to eliminate it entirely.

Here’s How You Can Benefit from

the Experience of One of the Greatest

Tech Experts in America Today

To implement our Future Shock strategy, we invited Jon Markman, one of the best tech analysts in America today.

To understand why, just take a look at the open positions in his long-term portfolio right now:

- ServiceNow — up 41.3%

- Veeva Systems — up 55.5%

- Trade Desk — up 54.5%

- Alteryx — up 58.4%

- Illumina — up 76.9%

- Booz Allen Hamilton — up 80.6%

- Salesforce.com — up 103.8%

- Alphabet — up 116.7%

- Schrodinger — up 141.6%

- Cardlytics — up 144.6%

- Microsoft — up 188.7%

- Amazon.com — up 346.1%

And bear in mind that these are just the gains Jon has in his long-term portfolio right now. They don’t include the many gains that came before that.

No, we’re not telling you to rush out and buy these immediately. That time will come in due order.

Nor is it possible for all trades to be profitable.

Rather, we provide these examples as evidence of Jon’s unbeatable, real-time track record — to show you how investors following his real-time picks should already be making tremendous gains in this great digital revolution.

The big news: Now, our Weiss Ratings subscribers are about to receive the full benefit of our new breakthrough strategy COMBINED with Jon Markman’s decades of experience generating massive tech gains from the markets …

Why Jon Markman Is One of the

Best Tech Analysts in America

When Jon Markman graduated from Duke the Columbia University School of Journalism, he wanted to become an investigative reporter. And that’s exactly what he did.

He landed his first job at the Los Angeles Times, where he was among a group of editors who won two Pulitzer Prizes for reporting, including one on the Northridge Earthquake.

But then an earthquake took place in his own life, a tectonic shift that changed the direction of his career: His father died.

His father owned several businesses, lots of real estate in southern California, even a private airplane.

But Jon’s mother was too overwhelmed to deal with it all. So, Jon stepped in to help her out.

Then he did what a journalist does best — he dug into the details and snooped out the rats! He discovered his father had four stockbrokers, and all four of him were effectively ripping him off.

So, he fired them and decided to go it alone.

He dove so deeply into the stock market, he decided to leave the L.A. Times and take a job with Microsoft. Then, he worked with the software developers at Microsoft to build something that had never been done before:

He and his team developed a stock-screening and stock-selection system that was entirely run by computers.

They called it “StockScouter.” And that system became the heart and soul of MSN Money, where Jon was the first managing editor.

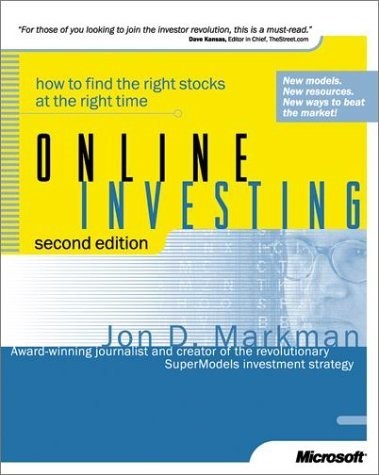

Jon also played a critical role in the digital transformation of the investment world in another way:

Jon Markman not only predicted the Great Digital Transformation, he helped make it happen

As Managing Editor of Microsoft’s MSN Money, Jon Markman helped create their StockScouter, one of the world’s first computer-driven stock selection tools. And his book, Online Investing, published by Microsoft, played a key role in moving investors to the digital world.

To our knowledge, he was the first analyst in the world to write a book introducing investors to online investing. And that was actually the title of the book:

Online Investing: How to Find the Right Stocks at the Right Time, by Jon D. Markman, published by Microsoft.

And for years, he ran one of the most profitable tech hedge funds in the country — largely using his own quantitative model.

All things considered, we could not have called in a better expert to help us implement our Future Shock Strategy, which is, in itself, one of the best tech stock opportunities in history.

Now, combining the power of the Weiss Ratings AND the power of Jon’s track record, we are launching a new service …

Weiss Technology Portfolio

Our goal: To build substantial wealth with the bulk of your money over time. Not just for your risk capital or a small portion of your nest egg.

And the benefits are enormous:

Benefit #1. World-beating performance: Following the Weiss Ratings strategy, you could have made a total return of 2,397%, including both winners and losers. That’s enough to multiply your money nearly 25 times over. And it’s enough to generate an average return of 159.8%.

Benefit #2. Solid protection in bear markets: This alone can make the difference between a miserable, stressful retirement and truly enjoying the fruits of your labor!

Benefit #3. Dr. Weiss’s personal commitment all the way: He personally designed this strategy based on nearly five decades of real-time experience with the Weiss Ratings, and his father’s 60 years of stock analysis experience before that. Dr. Weiss oversees the implementation of the strategy and is personally investing his own money as well.

Benefit #4. Jon Markman, the man Dr. Weiss has hand-picked to be Editor of Weiss Technology Portfolio. Mr. Markman is the man who managed the development of the world’s first online stock selection system, under Microsoft, when Bill Gates was running the company. And today, his documented, real-time track record is unbeatable.

Benefit #5. This strategy is suitable for your life savings, including IRAs and other retirement accounts: The Weiss Technology Portfolio is not designed for speculative funds or “play money.” It never uses options or futures. It invests strictly in solid, liquid, stocks and some exchange-traded funds (ETFs).

Benefit #6. The FREEDOM to enjoy your life: Just a few minutes each week. Simply check your inbox every week for your Market Alert, and it will tell you in easy-to-follow, plain English what to buy or what to sell.

Benefit #7. Huge savings! Normally, one year of Weiss Technology Portfolio is $5,000. But if you join now, you are entitled to our special Future Shock savings. Your cost is only $2,850. And that’s just the beginning of the savings you reap, thanks to …

Benefit #8. is Dr. Weiss’s promise. If you don’t achieve at LEAST a 100% return after your first year, let us know, and he will give you a second year absolutely free.

All current Weiss Ratings subscribers are eligible to claim this special charter offer — but only for a limited time.

To get started right away, simply fill out the information below.